The recent joint report from Ernst & Young (EY) and the U.S.-India Strategic Partnership Forum (USISPF) underscores how elevated taxes have severely impacted an industry that was once a burgeoning sector, attracting substantial FDI and creating over 100,000 jobs. Despite its potential to drive the Indian economy and create 250,000+ high-quality jobs, the onerous tax regime has led to funding challenges, revenue declines, job losses, and an uncertain future.

In aligning with global practices, India should clearly distinguish between games of skill and games of chance for online gaming taxation and regulation. India can benefit from this approach by bringing in new-age technologies and investments from across the world. Our study indicates that the impact is concentrated in real-time games limited to fewer players where the business model is still evolving. The gaming sector needs support to grow and bring out the best possible efficiencies.

Dr. Mukesh Aghi, President & CEO of USISPF- GTA 6 launch delayed further; website reflects November 19, 2026

- Call of Duty Black Ops 7 Beta receives mixed reactions

- Call of Duty Black Ops 7 Teases a Black Ops 2 Remaster Map

New GST Law Deals Crushing Blow to India’s Online Skill Gaming Industry

India’s pay-to-play online skill gaming sector is grappling with severe challenges due to a new GST tax amendment that levies 28% on deposits, according to a joint report by Ernst & Young (EY) and the U.S.-India Strategic Partnership Forum (USISPF).

The report highlights the detrimental impact of the revised GST regime on various game formats, including fantasy games, card games, and casual games. For some companies, the increased taxation has rendered their business models unsustainable, particularly for real-time casual games with smaller player pools. The report details the devastating effects of the GST hike, citing funding constraints, reduced growth trajectories, job losses, and heightened uncertainty across the sector.

Funding Challenges

Since 2019, the Indian gaming sector attracted $2.6 billion in FDI, with 90% of investments directed towards the pay-to-play format. However, since October 2023, no new capital has been raised, and several global investors have withdrawn due to the new GST regime. The report terms this period as a “funding winter,” emphasizing the withdrawal of significant investors at the onset of the tax hike.

Muted Revenue and Growth

Prior to the amendment, GST accounted for 15.25% of the revenue. Post-amendment, GST costs have surged, consuming 50-100% of the revenue for one-third of companies, and even surpassing total revenue for some startups, forcing them to operate at a loss. Over half of the sector’s enterprises are now facing stagnant or declining revenues, with 25% experiencing growth declines up to 50%. This marks a stark departure from previous growth rates exceeding 100-200%.

- New FPS horror Crossfire Rainbow looks promising, Targets PC and Mobile Platforms

- Chingari introduces Web3 gaming experience – Chingari Game Zone

- LightFury Games secures $8.5 million funding from Blume Ventures, others

Job Losses

Increased GST has led to decreased margins, resulting in layoffs, hiring freezes, and operational shutdowns. The report notes that the heightened tax burden has deterred the right talent from joining the workforce, exacerbating the sector’s woes and casting doubts on its viability.

Future Outlook and Recommendations

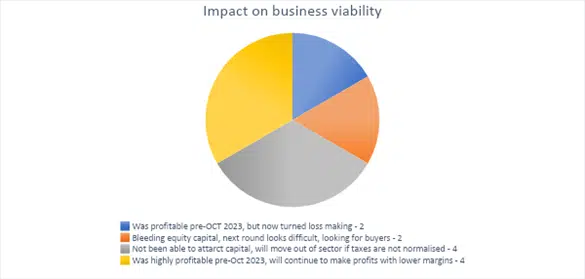

The report outlines a bleak future for the industry, with most companies either turning into loss-making entities or bleeding capital. It recommends amending the valuation mechanism for online money games to levy GST on GGR/platform fees, i.e., the amount retained by gaming platforms for operating a game, rather than the “full-face value of total deposits.”

This adjustment aims to make the tax burden more manageable and align India with global practices. Countries like Poland and Portugal, for instance, tax deposits at significantly lower rates of 12% and 8%, respectively, to maintain parity with GGR models and avoid overburdening the sector.